Have you watched the movie “Larry Crowne” starring Tom Hanks and Julia Robert?

**Spoiler Alert***

Larry Crowne (starring by Tom Hanks) is in his late 40 – 50s who works hard but never got promoted to the front office. Instead of getting the “employee of the month award”, his boss sacks him. One of the reason that he got fired is he never had a college degree and they need to downsize to meet corporate standard. He’s now stuck with a $400K mortgage without a job.

In one of the scenes, his SUV’s gas bill is $80 while a scooter is $9. So, he quickly makes changes and able to get out of the bad situation.

This is the real life story for many Americans in the crisis, people are forced to make some “hard” choices. If we don’t pay ourselves first, and it could happen to us and … then what?

For that, I’ve been setting money aside each month to increase my passive income, so even if I get laid off from work, I don’t have to have a job to pay my bills. In fact, I’ve reached financial freedom, which I could quit at anytime and have everything taken care of. I will not able to live a “lavish life”, I still don’t have a cellphone plan (regardless of managing 7 rental units, so what’s your excuse? :P), many people have different opinion of “slavish life” or “cheapskates lifestyle“, but I can tell you I don’t eat ramen noodle, I eat fillet mignon 1-4 times a week which we cook for ourselves).

This probably will be my last dividend increase for at least a year. All of the positions that I’ve sold to fund my $60K investment property purchase will make my dividend payouts.

However, I’m still excited about this month dividend payouts- close to 4-digit dividend income! That’s absurd, given that I work zero, zip, nil hour get this payout.

3/31/2016 CC $0.06

3/31/2016 UNP $22.00

3/30/2016 GS $6.50

3/30/2016 TROW $5.40

3/28/2016 BAC $423.75

3/28/2016 PFG $7.60

3/21/2016 D $70.00

3/17/2016 PRU $7.00

3/15/2016 DOV $4.20

3/14/2016 DD $3.80

3/10/2016 EM R$4.75

3/10/2016 IBM $6.50

3/10/2016 NSC $8.26

3/2/2016 FCPT $17.86

3/2/2016 FCPT $6.49

3/2/2016 TGH $4.80

3/1/2016 CMI $9.75

3/1/2016 F $69.20

3/1/2016 V $1.40

3/1/2016 WFC $198.75

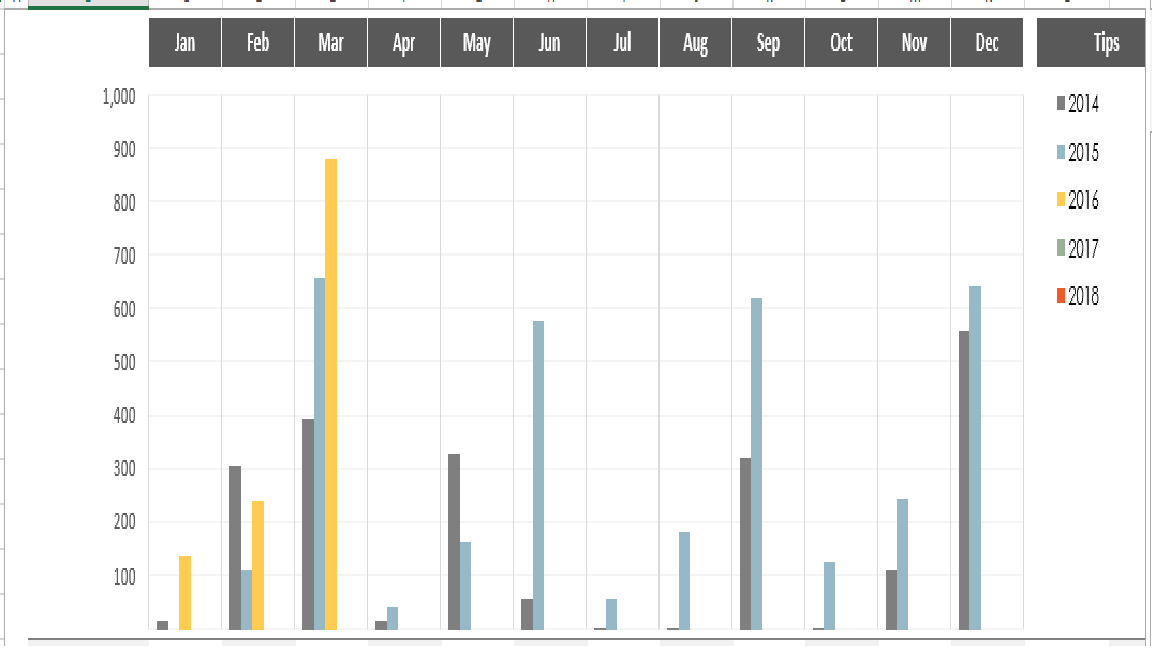

March Total: $878.07

Compare to last quarter it’s 26.87% increase

With this will bring the 1st quarter dividend of 2019 to $1253.99. Or an average of $418/mo. My goal is to have $500/month by the year end. Since, I’ve made the decision on the rental property, my dividend WILL be short of the $500 mark. I’m revising down to $300/mo as a goal for dividend for this year.

I still can’t believe it. How’s about you? When are you projected to get 4-digits dividend payout? or When was the last time you hit 4-digit?

Congrats on the passive income, Vivianne.

That’s a great amount and the progress from last year is even better. Keep up the great work!

R2R

I love to see the graph, it just shows that the snowballing effect works. Can’t wait to see your passive income report.

Wow that’s a great amount of dividends. On my side I am looking to get 4 digits dividends in 10 years or so. In march i’ve got around 4$ but I am starting so I find that good 🙂

That’s what dividend investing is all about, pennies to dollars, to tens of dollars, then to hundreds, and if we keep at it, it’ll be thousands.

I remember the days that I was making $200 and try to live off that. Hardwork and hard saving will pay off, you will get there soon enough, bro.

I see you guys will have a kindergarten school, having a business is the way to go. earned income is taxed at 15-37%, but business income is taxed at 15%, it makes no sense. But that’s what you have to do, own a business.

If owning a business isn’t good enough, we own 50 stocks, that’s 50 businesses, when we retired $36k of dividend income, we don’t have to pay a dime in taxes. Owning businesses is great!

Congratulations on your magnificent dividend income in March and the excellent growth from the year before!

Regards,

DH

Thank you! I’m excited! I how diversify your portfolio also. Keep up the dividend stream too, bro!

Great job with the dividend growth Vivianne. You’re really moving along on your journey. Thanks for sharing your progress with us. It’s inspiring!

Hope your week finishes out well

-Bryan

Thank you! I’m considering reporting the income generate from this property to add on to the dividend portfolio as I had to take a hit on my portfolio to fund this property.

Wow, who wouldn’t be proud of making this much money in one month. Nice work Vivianne. It’s too bad you had to sell so many shares. I’m sure your next few dividend updates will be much less. But, just remember you used that money to diversify into real estate. I think this is a good long term strategy.

I was pretty down about selling. Especially using up my free trades. But I’m happy to make 5-20% premium on each stocks that I sold as I bought them in the sell off last August and this February.

Congrats on $800+ dividend income. I will check if i can rent that movie in Japan.

If you have Netflix subscription, you can trick it to think that you are in the us, so you can watch the movie. 🙂

Awesome stuff. Almost $900 in dividends for the month and over $1250 for the quarter. The best part is that you didn’t have to do anything to “earn” those dividends. Looks like you doubled your dividend income for the month year over year. That’s fantastic!

You are right about that. Dividend investing is boring to most, there is no buying and selling, 2 baggers, or 10 baggers, but dividend will keep trickling in day after day, pretty exciting to see the pay checks flowing in. 🙂

Well, I am jealous of those numbers! Amazing income. Are you concerned that over 70% of that income is from the financial sector ?

I’m quite concern. Consumer stable PE are 20-30, tech stocks are also in 20-60 or not paying dividend except apple and Cisco. Apple is looming with China slow down, I think the street is underestimate the China situation with prime lending for stock and housing. When all the scandals for chemical and tainted product from China come out, so go the China export.

So that left with insurance and financial PRU PE of 6, BAC 8, most of them are around 10. I like the valuation for now.

I also like oil and gas companies, until some of them go bankrupt, the price will still be volatile. I’m willing to wait out a little.

I don’t like consumer discretion sector like restaurant or retailer other than Walmart.

70% of my 401k is in the s&p, 15% is in REITs, another 15% is in international and a various investment.

50% of my networth is in the investments property, which bring 80-90% of my retirement income. It’s almost recession proof as I rent to university students or low income people, rent per person is $350 max, most of my renters will be able to make rent. As long as I’m not greedy and increase by a significant amount, people will continue to keep my units full.

I’d like to have multi-source multi-streams of income, whether it’s dividend stocks or housing, I’m looking to diversify. At some point I might buy index fund.

Hey Vivianne that’s a great amount of income you received. Shame that you had to sell a lot of them but it helps you achieve your financial goals through real estate, so it’s all good. Nice job!

I hope you’ll build up your positions in stocks again 🙂

Tristan

No doubt. I reached FI, 100% of my earned income is saved. We haven’t even touch a penny in Mr. WRI saving. Once I quit my job, I could turn my 457 into Roth IRA and ladder it over the year and never have pay taxes on that. Pretty powerful stuff. I even can withdraw the “principle” five years after conversion, so I can continue to add on to my portfolio.

Pretty exciting stuff many years to come, my passive income will continue to rise during retirement, not declining, that’s the point. 🙂 saving early is the key.

Hey Vivianne,

That is an awesome dividend stream to complement your rental stream!! It is not easy to diversify that well across two different streams and you have achieved it. Congrats on the new rental as well.

By end of this year, I plan to hit $750 per month in dividends. My intermediate goal is to reach $1000 pm in dividends each month. At the current rate, with no extra cash injection, I anticipate to reach $1000 in three years appx. My first month dividend was appx $10 a couple years ago and I used to think how will I reach the level of other bloggers….as of last year, it was $650 pm. So, yes, you are right. Pennies become dollars and dollars become tens and hundreds of dollars aided by many sacrifices and some good ideas.

Keep up the awesome momentum!

Rome wasn’t built in one day. One wise professor at Yale did research on successful people, it boils down to – passion and persistent are the key to success, not the high IQ.

Keep at it and we all will get there with 4 digits average soon enough.

Amazing month, what else is there to say. I love the dividend growth rate you realized during the month. Congrats on purchasing an investment property and welcome to the wonderful world of becoming a landlord! Is this your first time owning a property?

Bert

No, I’ve a landlord for awhile. I bought a 4-plex in 2017. It’ll be my first out of state rental. (Although, it’s home for me in the Midwest).

Hey Vivianne,

nice dividend income in March. Hope to get there as well very soon. My monthly average is around 45 EUR right now but let’s see where it will be in 5 to 10 years :).