At the beginning of the year, I disclosed that I want to keep 10-20% in cash just in case of a correction. The DOW was hitting 18,xxx several times. I kept my strategy, the patience pay off. The DOW was down more than 10%, the s&p 500 was also down 10% into the correction territory. What do I do? Deploy my cash of course. I can rebuild the cash over time, but the market correction, a chance for me to improve the yields, I wouldn’t pass up on that.

At the beginning of the year, I disclosed that I want to keep 10-20% in cash just in case of a correction. The DOW was hitting 18,xxx several times. I kept my strategy, the patience pay off. The DOW was down more than 10%, the s&p 500 was also down 10% into the correction territory. What do I do? Deploy my cash of course. I can rebuild the cash over time, but the market correction, a chance for me to improve the yields, I wouldn’t pass up on that.

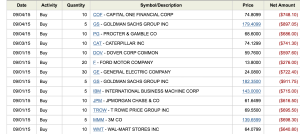

I have steadily been adding 5-10 shares of dividend champion stocks since the beginning of the year. I only bought when the stocks were down 10-30% from its 52 weeks high. My porfolio looked a little bit better when the market was down 1000 points, 10% for the year. Mine was down 6%, $12k. Thoughts was going through my mind, I should pay off my student loans with this, spend more on vacations, etc. But I quickly calmed down and deployed my cash to continue to average down and bought into beaten stocks.

I kept reminding myseft they were not broken companies,

They made a lot of profits and share only 20-40% of the payouts, so dividends will continue to grow.

They didn’t have much exposure with EU or china, so their profits shouldn’t be affected by much.

I bought them before and prices when way up, so when they were down again. Deploying my capital was the way to go.

I will hold these stocks for a long time, so the short term loss won’t affect my day to day life.

I have enough emergency funds so I don’t have to sell anything in panic.

Dividend added:

Goldman Sachs – GS – dividend added $26

Trow – added $20.8

MMM – added $20.5

Wmt – $19.6

JPM -$ 17.6

IBM – $26

GE – $27.6

F – $12

DOV – $16.8

CAT – $30.8

PG – $26.5

COF – $16.5

Total 1- year dividend forward: $261.2

Excellent strategy. I like most of the companies on your list. It’s good to get $261 dollars “locked in” which will double 8-10 years or less since you bought them with better yields.

D4s

I’d hope so. They have pretty track record for increasing dividend. We’ll see how ps the next couple years will work out. There are a lot of prediction of market crash out there. With these companies with solid cash dedication for dividend, I sure hope they hold up and continue to raise dividends. 🙂

Yous said it. These are not broken companies, just broken stocks. I always believed that these great price swoons only creates better buying opportunities for the patient investor. Solid list of names up there. Happy to be a fellow shareholder with you in quite a few.

It’s a crazy market out there, any sort of “good news” will cause a sell of fearing the fed will increase rate. Any bad news about growth will also cause a tsunami of sell off. Then they’ll rebound because of oversold, they don’t have any to short. 🙂

Anyhow, it won’t change the fact that will average at lease $300/mo in dividend payment this year. And probably increase by 50% due to continue buying. 🙂 cash flow is the key.

WRI,

Nice way to drop some cash and increase your forward dividend significantly. Those are really great companies that will reward you in the future. Keep in touch

LOMD