I had almost $200K of investment but my annual dividend would barely breaking $3000, so I set out to improve the yield. The best way to improve it to invest in high yield dividend paying stocks or REITs

Why REITs? Is it good with the interest rate increase? What are the risk?

1. REITs are slowly going to correction ranging from 10-20% decline YTD.

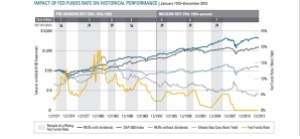

2. Data more often than not shows REITs would increase overtime.

Let’s look at the historical data:

PRE-MODERN REIT ERA — 1972 TO 1992 The pre-modern REIT era was characterized by fewer, smaller REITs that were essentially passive owners. This era saw four periods of dramatic and sustained increases in the Fed Funds rate. REITs experienced a positive return in two of these periods and negative returns in the other two

Period 1: 1972 to 1974 – Decrease – During this period, the Fed Funds rate increased from 3.3% to 12.9% and REIT returns were dismal. REITs including dividends were negatively correlated with the increase in the Fed Funds rate, losing 39% of their value.This, of course, corresponds to the 1974 bear market, which up until now, was the worst downturn since the depression.

Period 2: 1977 to 1981 – Increase -This was the Volker Squeeze. Interest rates made any financed transaction essentially impossible, as turbulent monetary and fiscal policy, end of the Vietnam War, a massive recession, an oil shock, and a paralyzed government (sound familiar?) All contributed to a spike in the Fed Funds rate from 4.6% in 1977 to 19.1% in 1981. During these turbulent times, REITs including dividends were positively correlated with rate changes and gained 110%.

Period 3: 1983 to 1984 – Increase – During this period, the Fed Funds rate increased from 8.5% to 11.6%. REITs including dividends gained 23%

Period 4: 1986 to 1989 – Decrease – During this period, REITs including dividends lost 3.3% as the Fed Funds rate increased from 5.9% to 9.9%.

MODERN REIT ERA — 1993 TO PRESENT The modern REIT era began in 1993 when the Umbrella Partnership (UPREIT) was codified, allowing large real estate companies with low-basis assets to access the public market in a tax-efficient fashion. This unleashed the market we now see with larger, vertically integrated, professionally managed real estate operating companies. These companies have more sophisticated capital raising and allocation models, and are typically more adaptable to changes in credit conditions. Most publicly traded REITs around today were not formed before 1993.

Period 5: 1993 to 1995 – Increase – The Fed Funds rate increased from 2.9% to 6.1% during this period, and REITs including dividends gained 21%

Period 6: 1999 to 2000 – Increase – The Fed Funds rate increased from 4.6% to 6.5% during this period, and REITs including dividends gained 17%.

Period 7: 2004 to 2007 – Increase – The Fed Funds rate increased from 1.0% to 5.3% during this period, and REITs including dividends gained 99%.

Why Rail Roads?

| Date | Number | Company | Price | Total | Yield on Cost | Dividend/share | Yearly Dividend |

| 6/24/2015 | 20 | BXMT – BLACKSTONE MORTGAGE TRUST INC | 28.9499 | ($579.00) | 7.10% | 2.08 | 41.6 |

| 6/24/2015 | 10 | DRI – DARDEN RESTAURANTS | 71.1 | ($711.00) | 3.20% | 2.2 | 22 |

| 6/24/2015 | 10 | DD – DU PONT E.I. DE NEMOURS AND COMPANY | 66.349 | ($663.49) | 2.80% | 1.96 | 19.6 |

| 6/24/2015 | 4 | NSC – NORFOLK SOUTHERN CORP | 90.0699 | ($360.28) | 2.60% | 2.36 | 9.44 |

| 6/24/2015 | 20 | STWD – STARWOOD PROPERTY TR INC | 22.64 | ($452.80) | 8.40% | 1.92 | 38.4 |

| 6/24/2015 | 10 | UNP – UNION PACIFIC CORP | 98.26 | ($982.60) | 2.20% | 2.2 | 22 |

| 6/24/2015 | 10 | WPC – W P CAREY INC | 61.34 | ($613.40) | 6.10% | 3.82 | 38.2 |

| ($4,362.57) | 191.24 |

DRI – Darden Restaurants, Inc. owns and operates full service restaurants in the United States and Canada. It operates restaurants under the Olive Garden, LongHorn Steakhouse, Bahama Breeze, Seasons 52, The Capital Grille, Eddie V’s, and Yard House brand names. As of July 28, 2017, it owned and operated approximately 1,500 restaurants. The company was founded in 1968 and is headquartered in Orlando, Florida. It will spin off the physical restaurants into REITs. BAC and JPM doesn’t like the fact the REITs will lease back to the ailing restaurants chain. Stock was back to the price prior to the announcement. So I seized the opportunity to buy. The REITs will diversify once the spin-off is consolidated.

DD – The struggling company operates as a science and technology based company worldwide. The company’s Agriculture segment, Electronics & Communications, Industrial Biosciences segment ,Nutrition & Health segment Performance Chemicals, Performance Materials, Safety & Protection segment, collaboration agreement with JinkoSolar Holding Co., Ltd. The company was founded in 1802 and is headquartered in Wilmington, Delaware. It will spin off its chemical segment with sticker symbol CC Chemours. Wall Street dislike the break-up, citing CC will carry a bunch of dividend that is not sustainable, as the result the company will be force to decrease dividend. DD to me is like AA and HAL back in the 1990s and 2000s. It broke up with PM, etc. And all of the businesses skyrocketed when after the break up. And dividend payout was business as usual. I bought DD because stock has plummeted from $80 to $66 or – 17.5%. I figured this would be a good entry point.

WPC – REITs Dividend Mantra’s analysis for WPC and more indepth here – I didn’t buy immediately at the time, but the stock has been down 20% from its high. The correction has begun. I don’t know when it would bottom out, but initiate buy would be the first step.

UNP and NSC – both railroad companies cover 2/3 of America rail road transportation. Wait, am I playing monopoly here? Nah!! I when Elon Musk figured out how to get high speed train and railroad for America. That’s when the America will get the upgrade, in the meanwhile they will continue to chug along as the republicans will not support any government backed plan to upgrade new railroads. Analysis are done by Dividend Mantra and My Dividend Growth

STWD – REITs will break itself up, introducing a new sticker symbol HOT Vistana Signature Experiences for its timeshare business. STWD has been down 10% from its high. I initiated a position. Analysis are done by Dividend Dream and Zero to Zeros.

Like the purchases, WRI. The railroads look great and am tempted to buy them.

Thanks for sharing your purchases

R2R

I suspect it will fall a bit more in the short future after the Greek deal goes through this weekend giving the FED more confident to raise rate.

Good buys here. Thanks for the link to my STWD write-up.

You are welcome. It was a great write up, and you actually write for Seeking Alpha. I thought I’d give you a boost!

Decent buys, but I might be worries about how higher interest rates will affect dividend stocks. I might look for more growth.

Did you sell something to buy these stocks? Do you have a progress chart as to what your returns are with your portfolio compared to the S&P?

Thanks for stopping by. It’s great to have someone like you to keep me on my toe about investment. You brought up a great question.

Since I’ve just started documenting returns, there isn’t much to report. However, Fidelity S&P 500 return at 3.1% YTD, and my account is sitting at 3.49% YTD. This is just arbitrary because I haven’t sold anything, and I am not planing to sell any of my position. But I am kind of setting up into the “retirement mode” income driven.

For example: D – dominion power – on the account, it shows I’m losing $289. However, it also pay me $259/year (the lost is negligible, the dividend income is reliable).

The company will not going anywhere. Between my tenants and myself, we are paying $15,000-$18,000 in electricity and we’ll probably will continue to pay at this level unless there is some miracle that we have our solar panels install for free that would generate the equivalent energy expenditure. Otherwise, Dominion will continue to charge us for many years to come.

They might decrease dividend like they did in 2007-2008 and 1991-1992 but both times, they were adjusting for the split 3-2 and 2-1. The stock weathered several major stock crashes in 80, 90s, 2003, 2007, and the up can coming correction. I guess, it’s the type of stock I’d like to hold on forever.

Keep those question coming. Thanks again for commenting.

Nice pickups! I think you’ll do quite well from here with all of them. Great post and thanks for sharing my link. Cheers!

Vivianne,

First of all, Hello and congrats on the good purchases!! I have been a silent reader, and have almost read every single post of yours! I sincerely appreciate your thought-provoking, and logical analysis! I notice that you mention that you were barely breaking $3000 in dividends, has your reallocation helped you? Do you have a projected dividend numbers for this year?

Thanks for stopping by and being a longterm reader.

At the beginning of the year, my strategy was to buy stock prior to the ex-dividend date to maximize dividend yield. However, as the year progresses, I found I can also maximize the yield if I also buying stock at the dip, or stocks going through correction. This year stocks has been very volatile, which benefit me in the buying stage, as I only add 10-50 shares at a time, then average up/down.

By this time next year I should have at least $2000 in dividend instead of $1540 if I don’t invest a penny more to my account.