The DOW has come off from 18,351 to 15,xxx twice with in the last 52-week range. As of this writing the DOW is 16,000. So what is the cause?

Summary:

- Greece Default

- China Slow Down

- Oil Plunging

- Oil GDP dependence countries defaulting

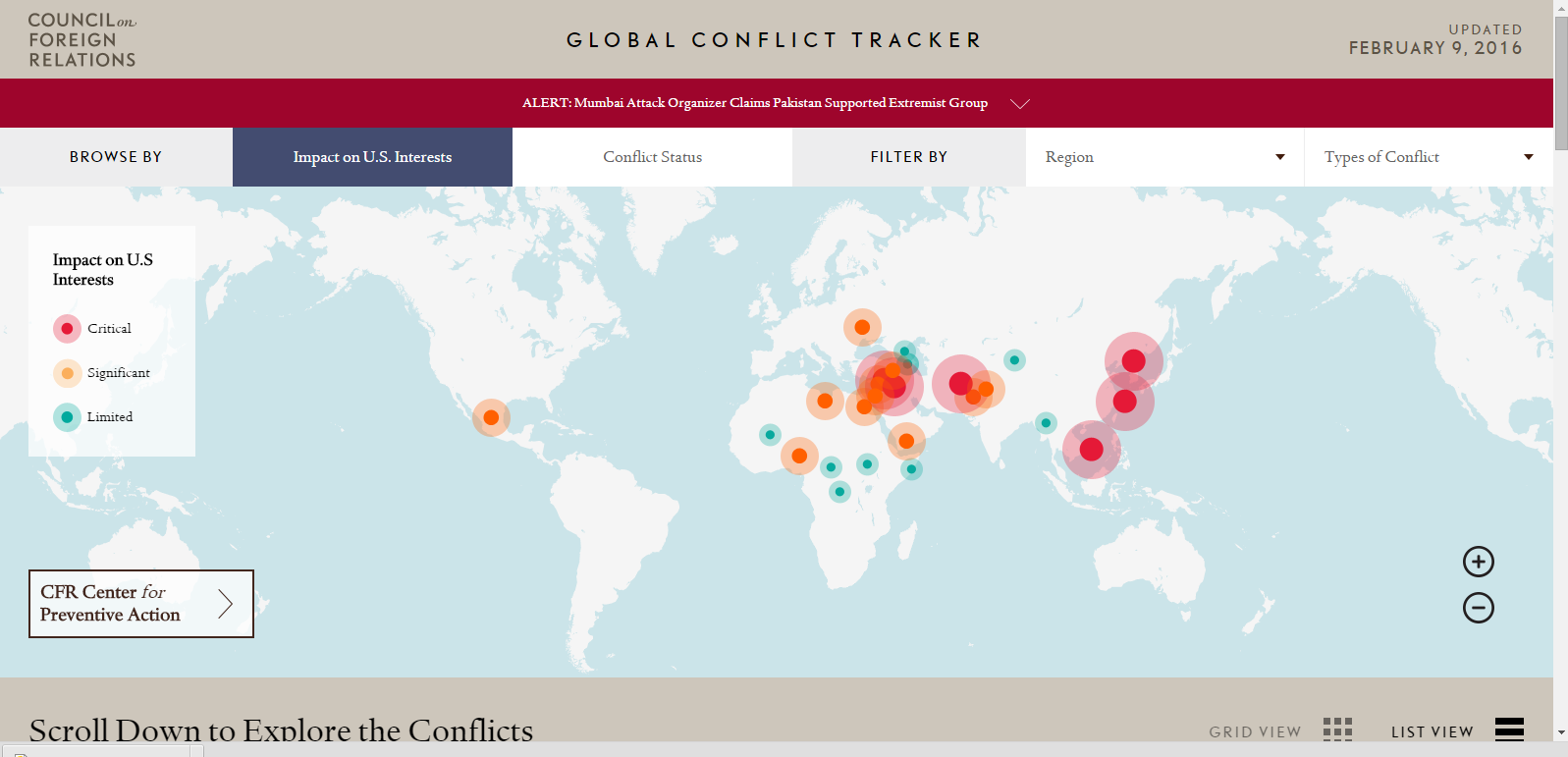

- Political Instability

Greece Default

The modern economy has changed since Ronald Reagan signed the paper for US companies to shift corporations oversea, and corporations from different countries can merge. That creates a tax loophole/benefit that companies like AAPL pay very little taxes in any countries that it base its business on. This would go well for awhile, it would work if there is only one company does it. However, they do it on the global scale. In 2008, it was the financial collapse. Today, it’s the oil and material collapse.

Greece is in one of the unique situation. In 1990s when the EU signed the treaty to have the common currency, the EU rejoiced. In fact the Euro was doing so well that it was worth for every $1, you can trade 1.25 Euro. The system works so well, that the whole EU benefit so much especially Germany, the EU was at one point went up as high as 1 Euro = $1.50.

From the 1990 – 2008, public, private and governments have borrowed a lot of money. And the world found out in 2009, that these entities simply unable to pay off their debt. Greece was caught in the middle of the financial collapse that they have no control over the money printing machine. Normally, when the country borrow, they could always print more money to 1. pay off the debt. 2. To make their currency worth less, to help with export. In 2012, the Greece’s situation has come to light. As we keep seeing the recurrent of Greece default in 2012, 2016, 2017, 2018 and up and coming 2019.

Several reasons that Greece has been the recurrent theme. However, the significant reason that can drive down the market is FEAR of the domino effect. If Greece collapses, they will more than likely to break off from the EU, then other high debt countries like Italy, Spain and Portugal will also want to erase their debt or go back to their own currency to print money. The fear of the unknown lies ahead is what causes the market’s jitters.

China Slow Down

From 1990s, China has been growing at 13-20% per year. That level of growth is simply unsustainable. Since 2009, China has been growing at >7%, and 2018 the world was shocked to see that growth in GDP has slowed to

China’s Slow Down recurrent theme has been popular and it then causes another domino effect. China’s demand. Demand for oil in particular is slow.

China Slow Down also impact US business such as companies that rely on Chinese consumption like JNJ, MCD, YUM, and especially AAPL. Hence any company relate to China or export goods to China will see a huge price drop as of late.

Oil Plunging

Oil has descended from $140 to the $20s recently brought no joy to the market.

First, the oil was priced so high in the $115/barrel, causing the oil companies to borrow tons of money to build more rigs, send more rigs to high cost area like offshore drilling. While this method of living on credit was going well for awhile, you see companies like Marathon oil, COP, BP, HAL and etc split several times and more. This went well as long as oil price stay >$60.

The global’s demand has slowed down. Causing China’s export economy to slow down. They are transitioning into a consumer economy which the production of oil is outpacing the growth of global and china. The result is plunging in oil price.

The impact is small and big companies will have to cut back production or slow down or cancel new build or exploration of oil rigs. They would cut cost by laying off employees or only use the existing oil rigs to minimize cost.

Laying off people will create a short term decrease in the labor market, some local economy in KS, OK, TX, FL will be able to absorb. Some small towns that were booming because of the oil might face some real pain.

The most pain is probably from banks. Big bank like WFC, C, and BAC might have 5-10% exposure in revenue from Oil related. While it won’t be a huge impact on the Cash Rich Financial sector, however, FEAR has gotten the best out of the market.

You see financially sound companies like GS plunged from $225 to $150s, MS from $40 to $20. C from $60 to $30s. Most of these companies has lost half to valuation since the beginning of the year.

Oil GDP country defaulting

Venezuela defaulting is a real threat.

Arab Saudi, Russia, Iran, Iraq, Vietnam to name a few will have some huge impact on the country balance sheet. While they will not be going into default, but short term pain is unavoidable.

Political Instability

Masked by religious war. We’re actually have an underline energy war.

- North and South Sudan

- English and French Cameroon

- North and South Nigeria

Big brothers get greedy.

- Russia took over Crimea from Ukraine

- China took over Parcels island in Southeast Asia, and other island that Japanese claimed.

- On-going North and South Korea war

The never ending war in Iraq, Afghanistan, Syria, and Israel.

Military coup becomes the norm – USA (Furguson and Baltimore), Thailand, Egypt, Nigeria.

Whenever we have loser, there are always winners

- Low oil price is a good thing. My personal gas expense has decreased by 50%.

- Apply to a larger scale, the cost of transportation and production have also been decrease.

- Consumer stable companies should be benefit during this period.

- China exportation is stimulated by the low oil price.

- The strong dollar means I can travel abroad for cheap.

- France traveling is 35% less costly than 1-3 years ago.

- REITs has been benefit greatly, Realty Income (O) has moved from $43 in September $57 in the recent trading session.

- Utilities and Telecom like D, T, and VZ has moved off from the 52-week low to the 52 week high.

What are the experts saying on what to do with the market?

Cramer says stock is not at the bottom

Leave account the same, or do nothing camp includes Mark Cuban

What are other bloggers strategy?

Divhut, Dividend Diplomat, Well Rounded investor, Dividend Samurai, Investment Hunting, Dividend Pipeline, Dividend Mantra (Jason Fieber), all have recent buys posts.

Div4Son is still making regular purchases.

AmberTreeLeaves has been hoarding cash

I’d assume we all are still bullish.

Buying strategy by retireby40.org –

| S&P 500 drops (off high) | RB40 plan |

| Less than 20% | Hoard cash |

| 20% | Invest hoarded cash |

| 30% | Move half of bond funds into stock |

| 40% | Move all bonds into stock |

I can’t speak for someone else, but for me, as long as dividend growth is still growing, I’d keep my account the same.

It are interesting times indeed… I started to think about an investment strategy

myself… I had hoarded some cash since June. I have a limit order in place to invest it… The day I have bonds, selling bonds will be a logical thing to do, as mentioned by RB40

Wow, very well prepare. You are very patient! What’s your cash to investment ratio? Or do you have a page on your website describing your strategy?

My portfolio is here: https://ambertreeleaves.wordpress.com/2015/08/07/my-portfolio-june-2015/

The different items I do are detailed here: https://ambertreeleaves.wordpress.com/2015/08/07/my-portfolio-june-2015/

Nice summary of the market factors.

I think the market is just be pushed and pulled by the loudest voices so I am planning on my regular investing (when I get some free capital.

D4s

That’s a great strategy! I, too, maximizing my 401k, investing $18000/year of my own money divided in 24 pay checks. I don’t know when is the big drop, I don’t want to spend too much time on timing the market.

I don’t have control over what the stock market is doing or the external factors. Right now I can only control in my saving rate and try to improve my monthly cash flow by being in the market and increase dividend income (earnings).

Sounds like everyone is still.hoarding cash and while market is down, there isnt any signs of capitulation of fear creeped in yet. Cant crash if thats the case, we need a catalyst here 😉

Crime rate is lower during the winter month. I’m afraid of the spring and warmer than expected winter this year. We don’t have to look to far for “catalyst” for the stock apocalypse.

Thanks for sharing Vivianne. No doubt those are some of the factors. Whatever the case, as investors, we just gotta buy low, lower, lowest and hold for the long term… and maybe sell sometime at the top for fun 🙂 However, dividends is wonderful while we wait and enjoy the income.

Cheers.

I am too heavily invested in energy right now and my portfolio is tanking, Gotta play the waiting game for recovery on my end 🙁

Lets start a waiting club then… 🙂 My oil investments are rather red for now. But I have strong beliefs that they will survive in the long term.

I’m buying and holding. By this i mean, I’ve made a few purchases, but I am holding back about 50% of the money I plan on investing until later in the year. I think as long as someone is not selling everything, they should be fine.

Very sharp and fitting summary. I’m thinking bullish too. Most of the wide market indicators I’ve analyzed, are showing buying signals.

Do you have a link to your analysis signaling a buying signal? It’d be cool to see. Thanks.