While speculating on increasing rent on my rental properties, and when the checks finally came in. I realized I didn’t have to wait until I turn 35 to be financial independence. I am financial independence! Wait, what? Yup! The total checks coming from rental properties along with the monthly paychecks from dividend income has exceeded my take home check from my job.

I gave myself 2 years from starting of this blog to settle any unsettling issues such as giving myself some cushions so I can give to my family more, travel without worrying about money (food, airfare or lodging), emergency fund, etc. I got there but I’m mentally not there yet. I also have many “what-ifs” –

What if I get a kid, 2 kid? my life situation would change very quickly.

What if the republican party win the election and take away ObamaCare? Ahhh another question of the century, health care, how to solve it!?

What if I suddenly don’t want to live modestly and what to spend big? I highly doubt I’d do this, but who know!

What if I get sued? Ahhh, the question of the century, everybody sues everybody. I need to turn my rental into a separate entities to protect what I’ve earned so far.

What If I get bored?

The uncertainties on major life events that keeps me from calling it quit at this particular moment. Caring for only myself is different from caring for mr, my dad, or even when we have kids. But I don’t even think I could quit working altogether base on the personality test result that I took a few years back.

Of course we will have to take any sort of test with a grain of salt, and the interpretation of the result is rest with the interpreter. And it looks like I’m in the ideal profession – healthcare.

Famous Personalities Sharing ENTJ Type

- Napoleon, an Emperor of the French (1804–1814/15)

- Franklin D. Roosevelt, the 32nd President of the United States

- Mark Anthony, a Roman politician and general

- Sean Connery, an actor and producer

- Madonna, an American singer, songwriter, actress and entrepreneur

- Yulia Tymoshenko, a politician and ex-Prime Minister of Ukraine

Oh goshhh… It sounded like I can’t work with other people, the only route for me is entrepreneurship – dictatorship.

- You have slight preference of Extraversion over Introversion (11%)

- You have moderate preference of Intuition over Sensing (25%)

- You have marginal or no preference of Thinking over Feeling (1%)

- You have moderate preference of Judging over Perceiving (33%)

Interested in what type of career work best for you?

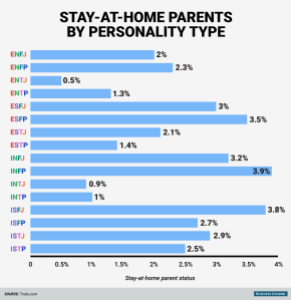

I was thinking if I have a kid, I’d more likely be stay home parent. It sounded fun. I was certain that I could do this until I see some of the stats.

0.5% chance of me be a stay home parent? What???!!! Well, you can’t take these test to the T. Come on!!

Would I be bored in retirement? It turns out, I’m also the type with only 3.5% of being unemployed. That explained the low percentage of being stay home parent.

So, I have over a year to track my expenses, turn my property into a company (corporation of sort), figure out life with Mr., figure out most of the what ifs, more than likely I won’t be bored with my life, but it would be cool to take a few months off, insurance?… I’m there, but I’m not there yet.

Would you call it quit after your passive income/semi-passive income exceed your work income?

Hey, great news about your FI. Really happy to hear it. Congrats! It takes a lot of hard work to get where you are. Enjoy this moment with a nice vacation with loved ones before the moment slips away!

From my personal experience, I have learnt two truths:

+ You need a downturn OR two to invest and reap the benefits of. We have one approaching now…should happen any time soon. You can keep working through the recession and pump any excess capital to strengthen your dividend portfolio. This way, your portfolio is risk diversified.

+ A portfolio is strong if it can take a 40% hit and still survive. So, lets assume that your portfolio dropped 40% in all areas: rental, salary, dividends, 401K, etc. Can you still FI? I know this is a bit conservative..but once you taste FI, can you really come back to the real world? Answer for me is no 🙂

That said, in the fight for FI, we tend to forget our daily life. Nice to see you are already thinking about it. My best wishes for all those to come true!

you are absolutely right, I need to do some case study before jumping the gun. A lot to sort out. It’s the uncertainty that scares me.

Hi Vivianne,

Congrats by the way for having your passive income surpass your work income!

I would definitely quit once that happens for me, perhaps even before then to take a leap of faith and start a business.

My main thing is I’d like to stay grounded, stay humble. I’m still way too young. I still feel I need wiggle room. So I’d still stick to my original plan. Retire right before I turn 36, still 35 :). So, it’ll be about a year and a few months from now.

A few more thing has to be done. I know I have surpluses every month. But I don’t track expenses to the T. So I need to do that for a few month prior to quitting.

Second, Mr. and I don’t merge income, but if we have a kid, that change everything.

Third, my emergency fund need to be $50K to begin with. I would be more if I have a kid. I also want to remodel my rental prior to quitting, so I don’t have to worry about big expenses when I stop working.

Forth, I need to find my post retirement job. Research, permanent teaching position, etc. I don’t like to quit without having a “job”. If I have a kid, I might, but still… if I take a few months off, I need to know that I’m coming back to something.

Congrats Vivianne, that’s an incredible achievement!

I’m very impatient, so I would absolutely pull the pin straight away and start making some changes to my life! Although it’s hard to know what fears you’ll feel once you’re actually on the edge, looking at taking the plunge… hopefully I’ll get to experience that feeling in the years to come!

Cheers,

Jason

Thanks for the best wishes. 🙂 I’m sure you’ll get there soon enough.

I toyed with the idea of just pick up and go to Southeast Asia for 10 years. Only live off $500-1000/mo. So let the money continue to snowballing. So 10 years later, I’d still double the net worth and dividend income.

Anyhow, with many uncertainty and Thailand has just had another violent bombing attack, I wonder how safe is it in a foreign country? With china escalating tension in Southeast Asia sea and it’s neighbors from India, Japan, rusia, Vietnam, phillipin, Malaysia, etc. I’ll have to have a solid plan prior to calling it quit.

Hi Vivianne

First of all, big congrats there!!!

I think you deserve to do whatever you have been thinking of doing out there, though i would agree with some of the above comments that perhaps some margins of safety needs to be considered. But just take it slowly yah, you have got plenty of rooms ahead of you 🙂

Yeah, I’m in no rush. I’m still on my summer vacation. Many more hours of planning before the “dear boss” letter 🙂