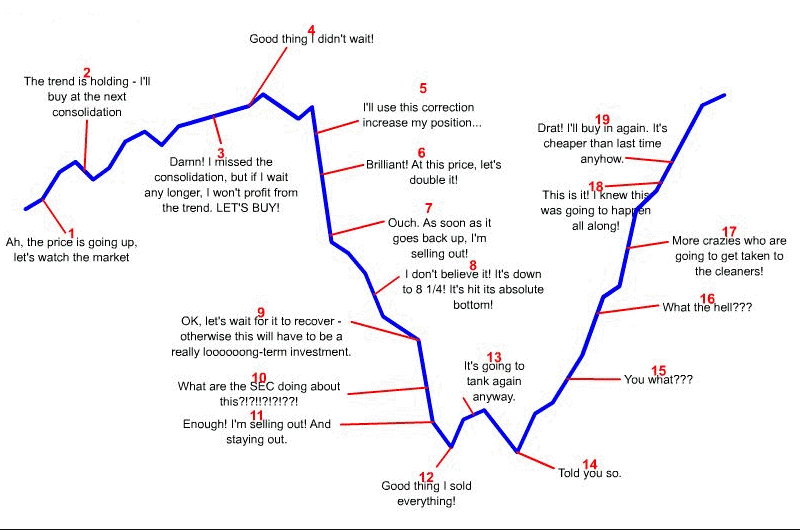

Pictured borrow from Dutchdividend Twitter page

Pictured borrow from Dutchdividend Twitter page

I bought 10 shares of

- POTash at $16.13 per share

- FOXA at $21.1699 per share

- UNP at $72.46 per share

POTash is a Canadian fertilizer company, with falling Canadian currency and lower global demand sent the stock to its 52-week low. I think the stock could call $12 or even to single digit if there is a major events. However, the current yield is interesting. I’d like to take this opportunity to average down my cost.

FOXA – well, this is the election year, fox is the only conservative network for republicans to turn. The mega big movie like Avatar 2 and 3 are being made and is due this 2019 Christmas and next Christmas by our blog buster director Cameron. This past weekend we rewatched the Titanic, the man is brilliant. Maybe, this is a bias buys, but FOX has been making a profit, the company will not go under even if there is a major international event.

UNP – I first initiate a position after reading mydividendgrowth’s blog page. The stocks since then went from $114 to $72, 30% decrease. I missed the buying opportunity back in September where the stock went down to $78, so now it’s $72, heck yeah! Buy! Buy! Buy! 🙂

The market has 3 sessions of triple digit loss (China manufacturing lags, and North Korean test hydrogen bombs) which is unusual starting for the new year, because people generally sell prior to year end to harvest loss, then buy again in January. I’ve stated in my goal that I’d like to make an average of $500/month in dividend, so I’ll pace myself if the stocks go down further, I’ll buy more.

Building cash is still my number one priority. I’ve reached financial freedom, so my risk tolerance has changed.

Have you bought anything for the new year? What do you think about my buys? What level are you going to jump on the oil and gas companies below?

I’m on the look out for BP, COP, CVX, XOM, and possible NOV. I have not initiate an energetic position yet beside KMI, but I’ll buy soon, waiting for another big sell out when investors get spooked out at earning seasons. Yields are amazing BP is almost 8% (it might get bought out), so yield will decrease.

Full disclosure: I’m long UNP, POT, and FOXA

Nice purchases, Vivianne. UNP is a company that I’d like to own for the long haul. POT – I am not crazy about as much as most DGIs in the community seem to be. FOXA – is also a good company and I am interested in learning more, but need to read up before I come to a decision. Some nice purchases that will send regular dividends your way.

Best wishes

R2R

I expect POT and UNP to announce some operation cut at some point to cut cost. If we take a deeper look at UNP, it’s a transportation company, even revenue decrease, but cost of fuel also decrease. We might see $60s or $50s level if “all hell break loose” as someone might have put it. At that point, I might double and triple down for sure.

FOXA might go down further to $22 or even the $teen level, but mr. Bufffett has been buying some, he might even negotiate a better deal to buy special class of stocks with higher yield than the current 1.1%. The PE is 6, lower than other stocks in the same class (CNN (Disney stock PE 20) cbs 12).

But I don’t know where is the bottom. I might lose more than $500/month buying at this level, I might have to wait 5 years to for them to come back to this level. But I’m not planing on selling at this point.

My goal is to have $500/month floating in from dividend income this year. That number won’t be reached if I keep sitting on pile of cash. 🙂