Happy Halloween Everyone!

I don’t really dress up or anything, so this year, I’m just being myself. 🙂

Well, you’ve noticed that I’ve changed the write up from October Dividends to October Dividends/Passive Income. For the first time, I’ll include the rental property that I’ve bought from out of state, in the Midwest, as my total passive income.

In short, I didn’t spend any actual labor to it. I paid my family to get the house up and running for me. (Mainly, all the work I’ve done to it was to click the mouse, make a few phone calls to buy the property on online auction, talked to the auction company, closing agent, bought the insurance, talked to my brother to check on the progress, talked to my sister to so,she can write couple checks. But I didn’t have to do any work to it to get the house ready. )

I withdrawed $77k to have the house up and running.p, the majority of it was from my taxable investment account. Therefore, it’s only appropriate to include the income. 🙂

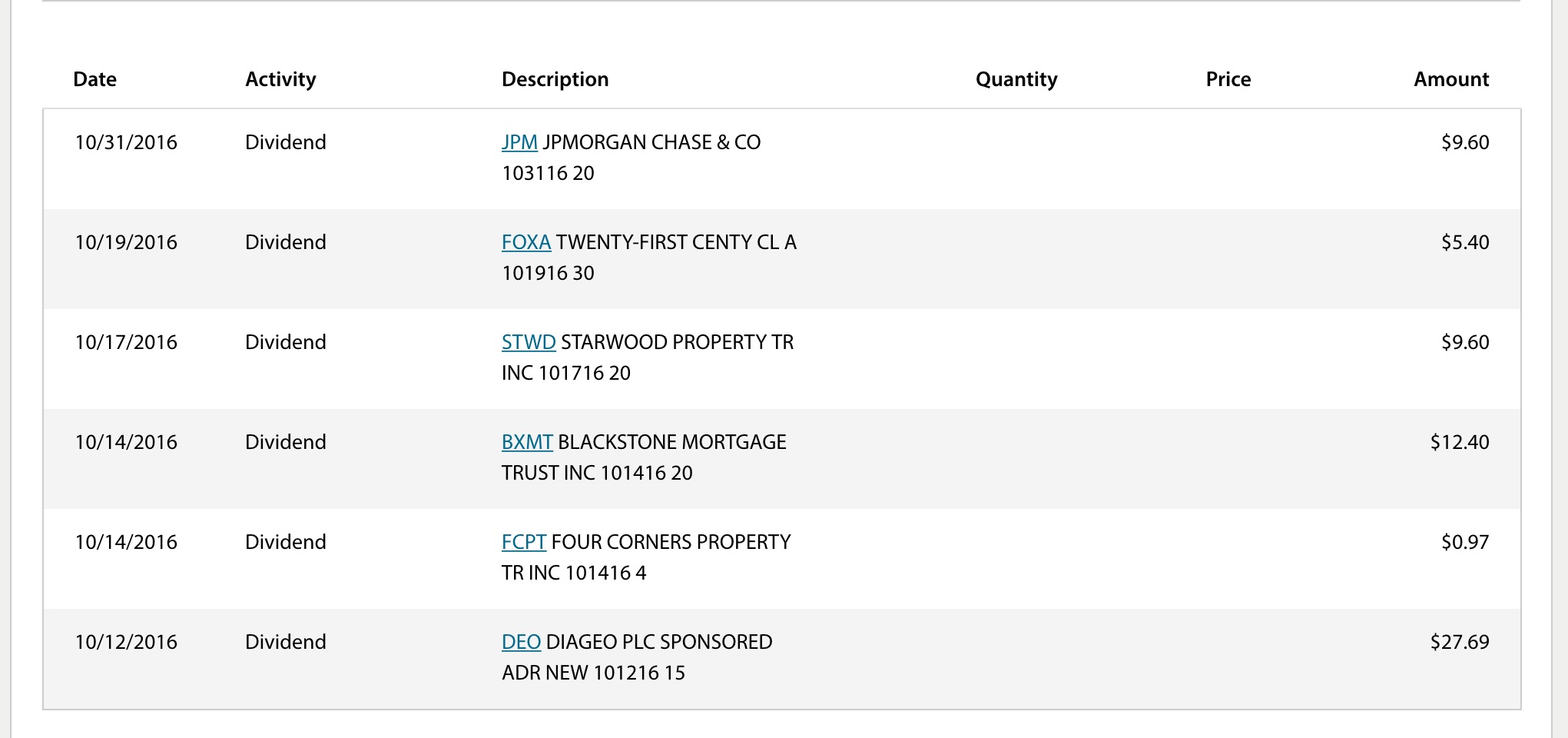

here goes:

dividend income: 65.66$

rental income before expenses: $1200

Total for October: $1265.66

2016 Dividend:

January: $134.54

February: $241.38

March: $878.07

April: $141.29

May: $47.75

June: $744.26

July: $32.57

August: 60.95

September: 877.97

October:1265.66

Total: $5024.44

Outstanding amount and rental is part of passive income so you should include it. Good job

Awesome stuff. That rental income is solid, what’s it looking like after expenses? Are you planning on rebuilding your portfolio do you have your sights set on another rental property? I’d love to add some rentals to the mix, but at this time it just doesn’t make much sense. Maybe if I could find a good property where $40-50k was 50% down I’d consider taking on some more debt.

I’m actually making quite a few purchases, and whenever I have time to do a write up on them individually.

Man, I saw another beat up house, even closer to the river, listed for $17k (a lot smaller size 730 sqft), but when I call the company, it’s under contract.

I probably don’t want to get involved in another rental, unless the house is in ideal location with great price. Otherwise, I’d like to continue to contribute to the portfolio to get dividend income. Money will roll in, as long as I find deals on beat up sectors. But cash is as high as ever among the millionaires, maybe they know something I don’t, but I’m going to still keep cash on hand in case Trump gets elected.

The first of many dividend/passive income reports. Your dividends are continuing to roll in which is always nice to see even if you have a month or two without a renter. Will you be writing a detailed post about your rental property that shows the expenses of running. Congrats on this new investing adventure.

More on expenses will come soon as the bills roll in. I don’t know if there will be any surprises for a month or two. There is always something with rental property.

Like there is a raccoon in the ceilings, as we fixed the hole in the siding, blocking the entrance/escape route. So, it’s been stacked in the ceiling for a week. My brother drilled 2 holes, hopefully it will come out by itself and not dead.

I’m praying for the raccoon and for us.

Great work! I’m very excited about your rental income, and would love to know more. Do you talk anywhere about it in detail on your site?

Wonderful news! $1200 boost every month is a killer addition! Kudos.

Assuming that after costs, you get an monthly passive income of $1000 i.e. it is $10000 per year. To generate the same passive income using stocks, assuming an average dividend yield of 3%, one would need appx $300,000. You have invested $77K instead for the rental passive income stream. Killer addition truly!!

Unfortunately the number will be far below the $1200/mo. I’m surprised the taxes and the insurance. I forgot how high the taxes is in the Midwest where I’m from.

But thanks you for the word of encouragement.

Just to picky about your math, $1000/mo =$12k/year. 🙂

Ahh…good picky! I mentally dropped two months to account for vacancy….reading up on rental investment you know 🙂 But I should have stated that. Thanks for pointing this out!

Awesome job on that rental income! How much time do you figure you spend each month maintaining these properties?

I don’t spend anytime on the property in the Midwest. I pay my family $50/mo for keeping an eye on the property and collect rent. I slot $120/month for surprise repairs, although I updated everything plumbing, electrical, new hvac, new fridge. I purposely didn’t put in a dish washer or a food disposal or there would be less things to be fixed.

If the $120 go unused, I could either use it or can save it up to build a car garage, paint the outside, install new Windows, new concrete for driveway. None of these things need to be done immediately.