Back in January, I spotted a house in the prime real estate area on auction.com. And it was on auction, but it was a live one. So I decided to check it out. On a cold Wednesday at 1pm. I was there 30 minutes early. I saw a few guys there, and I went and talked to them to see what kind of property they came for. Needless to say, we were all there for the same one. It was a fun day, I didn’t get it, but I would like to share my experience with you to see what was the fuss about buying a foreclosure house at the courthouse steps.

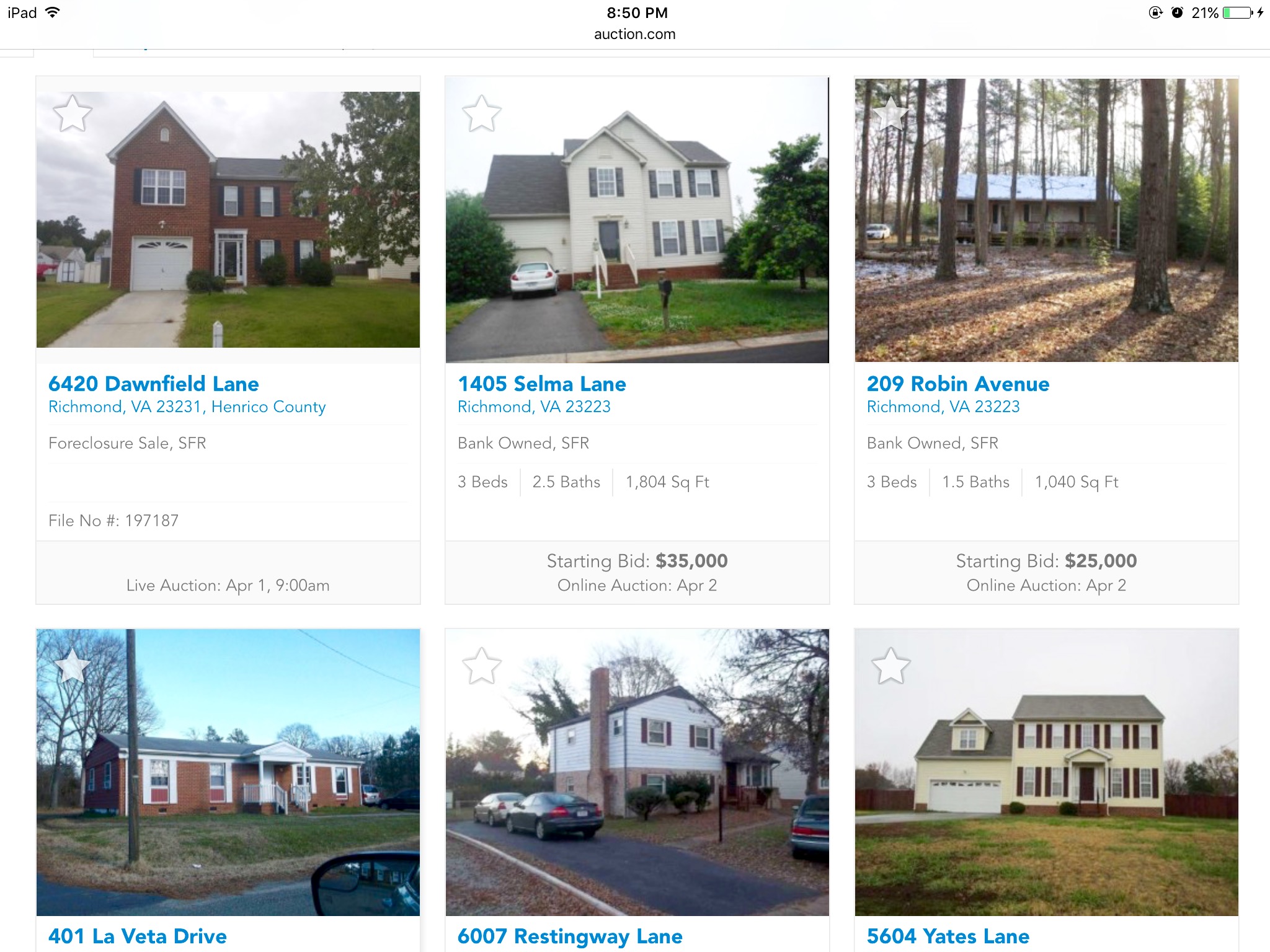

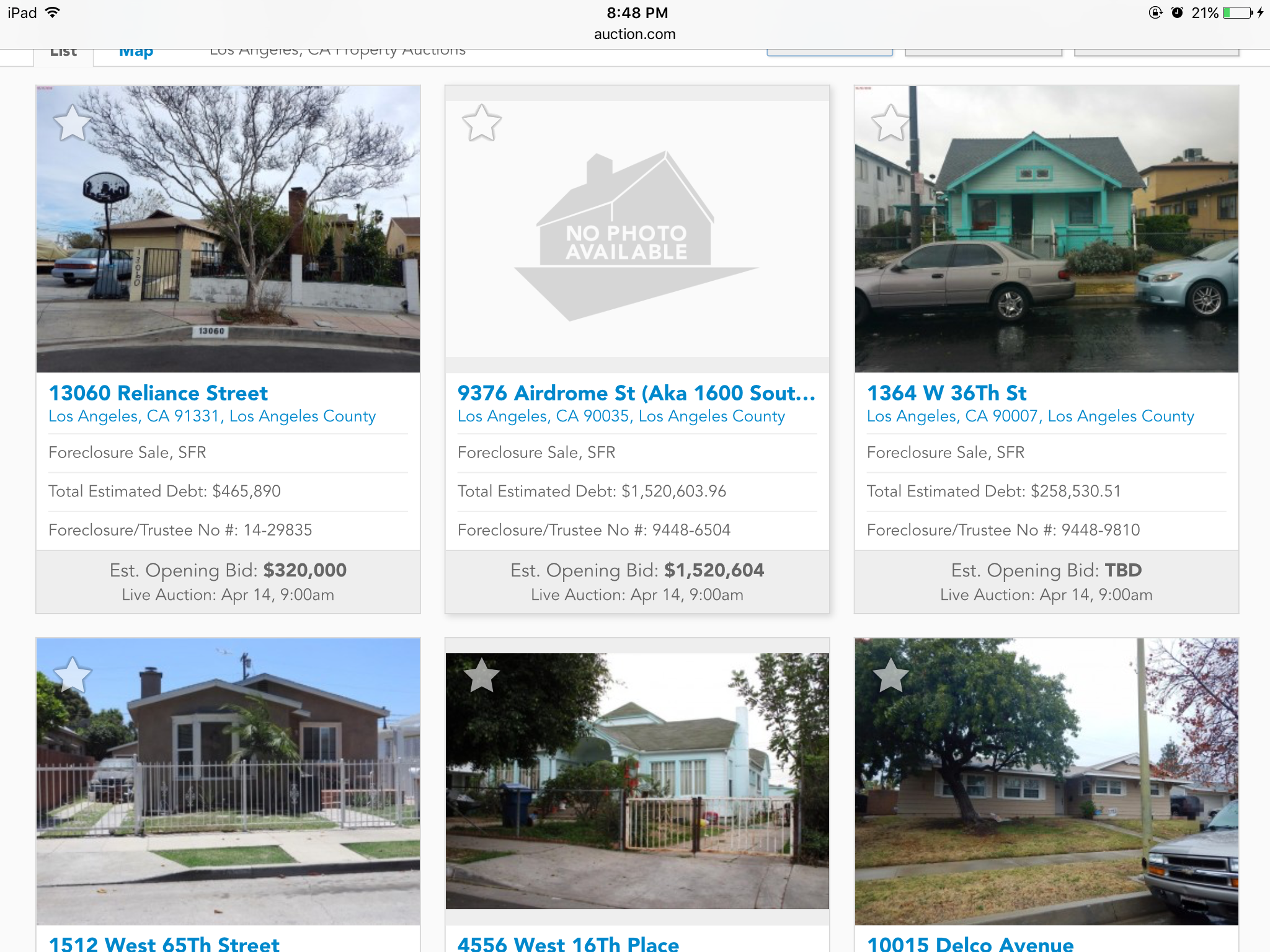

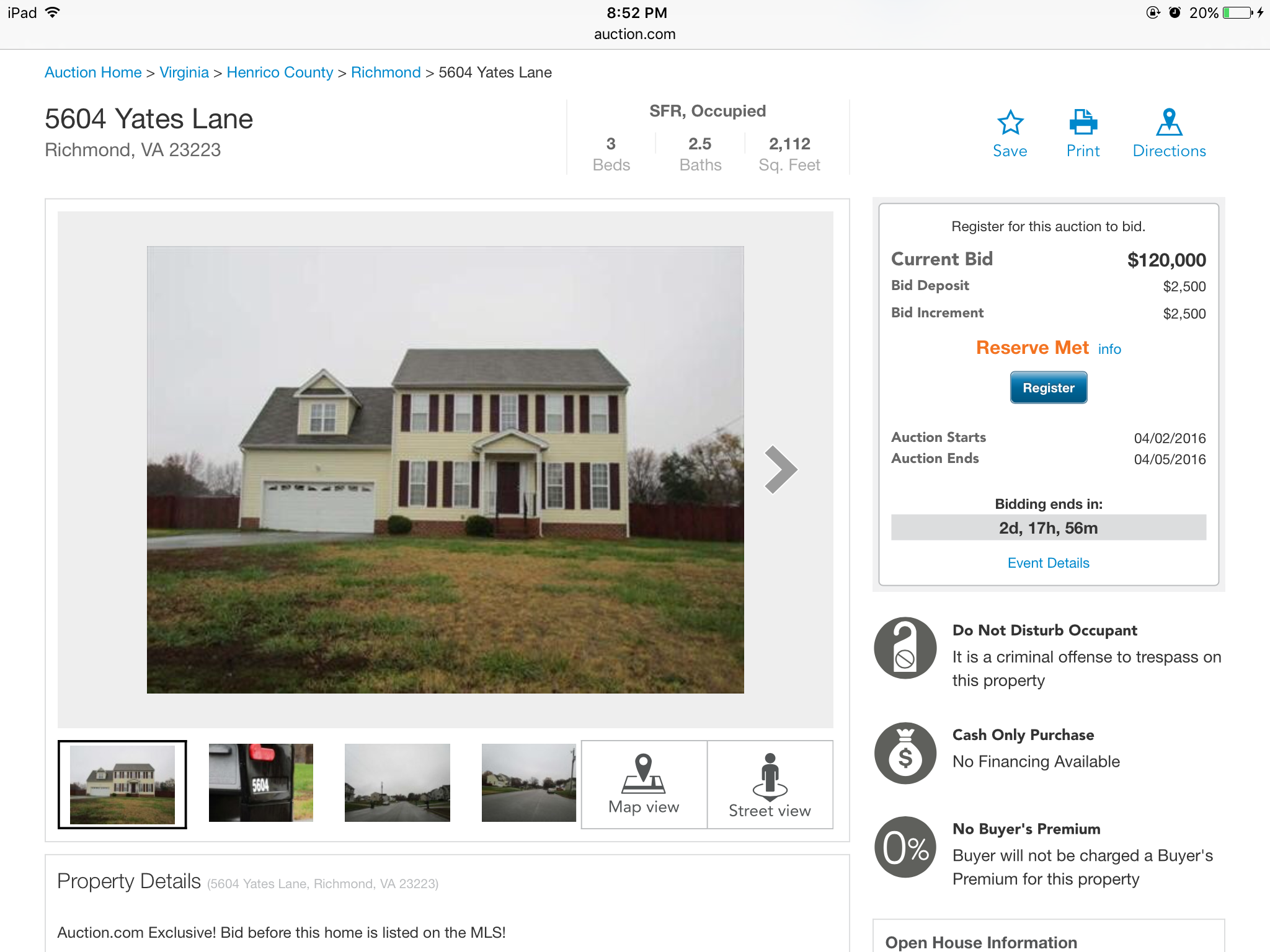

If you check Auction.com you’ll see houses listed for $10K, $20K, while the neighborhood houses are listed for $100K-$500K, and wondering why the house goes such as low prices. Well, back in the 2009-2014 you might be able to scoop up the houses at those prices. But today, you won’t be able to do that – $10K or $20K are the starting bidding price and the site is allowed to bid against you. They have a reserved price, like back in the day with eBay.com. Nonetheless, you can still get a house for $30K-$100K below the market price.

I personally bought a house from auction.com, and both my sister and brother bought foreclosure properties on auction and from Zillow.com. This was my experience, and what I learned from my siblings.

In my city, the lawyer/trustee/auctioneer who represents the foreclosure/bank company will offer bidding once a week on Wednesday. In the two countries surrounding my city, they do it on Tuesday and Thursday. You can check locally base on what they say on advertisement as “Trustee Sales” or Auction.com and click on a specific house.

Summaries:

- You need cash

- You need experience

- You need to do research

- There are some key points to remember

- How to bid

- Risks associate with buying foreclosure house

1. You need cash

In order to make the bidding, and successfully secure the buy, you need to give the trustee 10% of the selling price or $10K-$15K in cashier check. So prior to going to to the court house, you can stop by at your bank and buy the check, return it if you couldn’t find a deal. At my first visit to the court house, I did not bring the check, I just wanted to see how things work.

Every county is a little different, but one thing is a constant in all foreclosure auctions: Cash is king, as certified funds are required usually within 24 hours of winning the bid and making any initial deposits required. Some trustee wants money immediately.

2. You need experience

I am not a newcomers to buying houses at a low price, I bought a 4-plex that is now replacing my day job’s take home income. I also act as general contractor when I was finishing my 1500 sq garage.

In terms of the foreclosure auction itself, I had no experience, so I figured I need to attend a few auctions myself to see how it works, learn what the rules are, meet the regulars and such.

Also bring a “smart” device, sometimes there are houses that’s not in the list, and they decided to auction anyways, if you can quickly gather the information online, even without sight-unseen, if the land itself is worth more than the property listed, so why not?

One instant, at the end of the auction, another trustee jumped out and announce that he has another house for sale. If you have a smart device, you can quickly do google street view, zillow it to see if there is any interior picture, what is the tax, school district, neighborhood, etc.

3. You need to research

The simplest and most effective way is:

- get to know your city assessor website. Some very accurate/official assessment to the house of interest will be there. If the ex-owner make some changes and never get inspection for it, it’s technically illegal for the addition to be there, so you’ll have to be careful when you sell it.

- get on auction.com to see which houses is going to be sold “live auction” or “online auction”. Life auction will be sold on the steps of the court house.

- Then you go on zillow.com and click on “foreclosure information” or assessor office, sometime it will show how much the house was last sold for, and how much the ex-owner foreclose on (or still owe the bank). That will be the “reserved price” or the “starting bid” at the live auction.

**Never skip this step**. Because that is your bread and butter. That is how you determine the house is worth the price.

- Go back to Zillow or the assessor office to search for nearby homes in the area or the neighborhood, to see how much it’s selling for for the same style or square footage. Most of the houses listed, the owner has paid 20% down, and the bank is only selling for the balance, so you’re looking at at least 20-30% appreciation or equity immediately after you bought it.

- Go the the actual house itself, if there is a realtor name on it, with a lock box, ask them for you to come inside. If the house listed as “occupied” that option is not available. You need to get a feel for the neighborhood. Forget the cash that you can bring in each year – your safety comes first! If you don’t feel safe going into the neighborhood to collect rent or go to to a quick fix on the house, then don’t buy it.

Next, research each property owner (also listed on the County Appraiser’s property record page) online via the County Clerk of Courts Public Record Search because whatever that the owner owes regarding that property outside of the loans (liens, back taxes, etc.), you will owe when you purchase a foreclosure home.

4. Key things to remember

Just because the property is offered for sale at public auction doesn’t always mean it’s a good deal. Often, the opening bid equals the judgment amount (the money the bank is trying to recover) or more and includes the original purchase price or plus a second mortgage, other home equity loans, interest and legal fees. The opening bid is ridiculously high compared with its current assessed value. These high-priced properties revert back to the bank because nobody bids on them. What you are looking for is an opening bid way below the current assessed value, and these are few and far between.

5. How to bid.

Make sure you arrive early enough on auction day to go to the correct county courthouse office to register as a bidder and receive your bidder’s number card. Leave time to approach each bank rep for the opening bid necessary for properties you might want.

When the auctioneer arrives at the sale site:

- He/she will announce some specific rules about deposits for a winning bid.

- When the auctioneer announces a property (by case number, not by address) you want to bid on, hold up your bidder’s card and announce your opening bid.

- The auctioneer will repeat it and then open it to other bidders to counter.

- Always have a ceiling in mind, and stick to it. If it goes higher, drop out.

Buying foreclosure homes come with many risks:

1. Bidding Wars

In the heat of the moment during an auction, it can create bidding wars! If that happens, it’s possible that the price can be run up to actual market price or even above. One or more bidders who want to buy the property as a personal residence may be locked on the property and not too concerned with resale value.

Know the market value of the property, adjust for condition and anticipated profit, and don’t ever bid higher than your pre-determined maximum price. Never go higher than the ceiling that you’ve set.

2. Property Condition

An inherent problem with foreclosures is that you generally won’t be able to do a home inspection. Occupants tend to stay in foreclosed properties until (and after) the last minute, and won’t let you in to inspect. As well, the property could have major structural issues that will be your problem after you buy the house. You’ll be buying sight unseen!

Do a drive-by inspection and look closely at the exterior and the property itself for clues. If it’s a wreck on the outside it probably is on the inside. Foreclosed owners sometimes destroy the house intentionally. There is a reason/ a big $$$ reason or reasons for them to desert the property instead of sticking around or short sell it.

3. Title Issues

Never assume that the mortgage is the only lien on a property. If the house is in foreclosure, there are probably other liens as well.

Order a title search on any property you are seriously interested in that way you’ll know what you’ll be getting into.

Often, the houses that are on foreclosure, they only provide the quit deed and you might have to pay for the abstract itself. In some States, it is required by State Law to have a 40 years history on a property in order to have a clear title. Buying is not a problem, but selling is a problem when you don’t have a clear title, it might bite you later.

4. Previous Owners Who Won’t Vacate

The previous owners of the house may not leave after you buy their house. You may need to use legal action to have them removed, at your own expense.

As an alternative, either bid only on properties known to be unoccupied, or be ready to offer a cash incentive for the previous owners to leave. Or it takes at least two months to get the court paper work for the person to leave. If they retaliate, they might damage walls, take rails, faucets and other accessories that they can remove before they take off.

So far, we have been lucky that the occupants leave as soon as they received the letter to move out.

5. Financing Issues

Lenders have standards that don’t usually fit well with foreclosure properties. When you buy a foreclosure, you take it as is; the lender will usually want certain items repaired, and that’s not going to happen. Lenders will also be concerned if you’re buying the house for investment, or worse, to flip for a profit quickly.

Buying foreclosures probably won’t work if you need to get a mortgage. Pay cash, or partner with people who can. Before going in, you can get pre-approval and have at least 25% of the total price of the house as deposit, or a small local lender might work with you on the investment rental.

6. Post-Foreclosure Issues

Some states allow a waiting period after an auction sale, during which the previous owner can buy back the property if they can match the highest bid. If you live in one of these states, you could win the bid and still not get the house.

Buying foreclosures can be enormously profitable. But as you can see, the potential to overpay for the property, to encounter major repair costs or to get into legal entanglements is real. Proceed with caution!

Please let me know if you have had any experiences buying or have stories you’d like to share. Good luck buying your first foreclosure or rental property.

There are more than one way to think or do things 😛

Great info Vivianne. I’ve never bought a house at auction, but in 2008 I lost a few to auction. Some lucky people got homes I owned at a great price.

It’s unfortunate that you lost several proper during the crisis. I think if I would have waited a couple years before buying my property, I’d gotten a lot more for my bucks, but in hinesight, it’s 20/20.

We don’t know what’s going to be in the future. That’s why I like dividend paying stocks, having a small mortgage that if I had to work a minimal wage job, I will be able to pay my bill. That’s also one of the reason I’m paying cash for the rental property, I don’t want to risk of getting foreclosed on a foreclosed property to benefit the banks.

Wow… this is a mine of information! thank you for sharing! I’ve always wondered how the foreclosure housing market works. I don’t think it’s for me though, it is still an intensive cash investment and I don’t have enough liquidity at the moment.

Do you calculate your rate of return as you do with your investments? what is it like after a few years?

Thx!

Mike

The assessor office taxes it at: $93K, neighboring house with 1200 sqft (this house 1593 sqft) is going for $120K.

Potentially if the real estate market is stabilize in the midwest it will go $100/sqft, it would make this house $150K. Given the location (approximation of park, and river, downtown, and public transportation), the house should move and have an easier time to sell.

I’m not selling, because I plan on living in it. If I decide to sell by mid summer after I have it all clean and fixed up, I’d probably listed at $130K and might get it to sell for $120k. I could easily sell it for $100k.

But what I want is $1200/mo on rental. Just pure cashflow each month. If it just rent it out minus tax, insurance, and management fee, ROI should be 20%.

if I sell it for $100K, then it’s a 74% return, but my tax bill at 35% on capital gain. It’s probably not ideal. I’d rather make money slow and steady. LOL:)

That’s a very good way to see it! and such calculations appear to be easier to make compare to how we will do on the stock market 😉

cheers,

Mike

Thanks for all the info Vivianne, very interesting to read, though I’m not sure if we would ever buy under those conditions.

In answer to your dog & jeans question, I think the dog would wear 2 pairs of jeans, one for each set of legs.

Tristan

My husband and I are considering making our first property purchase in hopes to resell or rent. We have no experience but are researching as much as possible. Do you have any tips on websites or other resources to educate us so we dont get in over our head.