Summary

- I initiated a position in DIS pre-earnings, securing an initial yield on cost of 1.48%. That’s a low yield, but dividend growth potential more than compensates, in my view.

- With a payout ratio below 28.9%, DIS has ample room for continued and rapid dividend growth.

Feb 2, 2019: Bought 10 shares of DIS at $93.xx per share.

The Walt Disney Company (NYSE:DIS), more commonly known as Disney, is a diversified international family entertainment company based in Burbank, California. Founded on October 16, 1923, by Walt Disney and Roy O. Disney.

Overview

Walt Disney Co., together with its subsidiaries, is a diversified global media conglomerate.

They operate through five segments:

- Media Networks (43% of fiscal year 2017 revenue);

- Parks and Resorts (31%);

- Studio Entertainment (15%);

- Consumer Products (8%);

- Interactive (3%).

Disney owns a number of different, but complementary, businesses in media and entertainment. Perhaps most well known, they own and operate the Walt Disney World Resort in Florida and the Disneyland Resort in California. They also wholly own, have ownership interests, and/or collect royalties from a number of related parks, cruise lines, and resorts across the world. Have you heard of Disney Paris? Or the up and coming Disney Shanghai?

Assets in media broadcasting:

- ABC broadcast network and eight television stations

- Cable assets in ABC Family,

- Disney Channels

- 50% stake in A&E Television Networks

- 80% stake in ESPN

Studio entertainment includes live-action and animated motion pictures, direct-to-video content, musical recordings, and live stage plays. Distribution of this content is primarily through the Walt Disney Pictures, Pixar, Marvel, Touchstone, and LucasFilm brands.

Of course, they also work with publishers, licensees, and retailers throughout the world to manufacture, market, and license consumer goods based on their intellectual properties. Does it sounds familiar with our FIRE theme? Disney actually have a side income from royalties pipelines and I’d like to get a tiny portion of that.

Disney pays dividends annually in the month of January and has a streak of 5 years of dividend increases. My initial yield on cost (YoC) is 1.48%

Yield on Cost

| Growth Rate (1-year) | Yield on Cost (1-year) | Growth Rate (3-year) | Yield on Cost (3-year) | Growth Rate (5-year) | Yield on Cost (5-year) | Growth Rate (10-year) | Yield on Cost (10-year) |

|---|---|---|---|---|---|---|---|

| 110.50% | 3.03% | 44.50% | 4.34% | 35.90% | 6.68% | 18.40% | 7.8% |

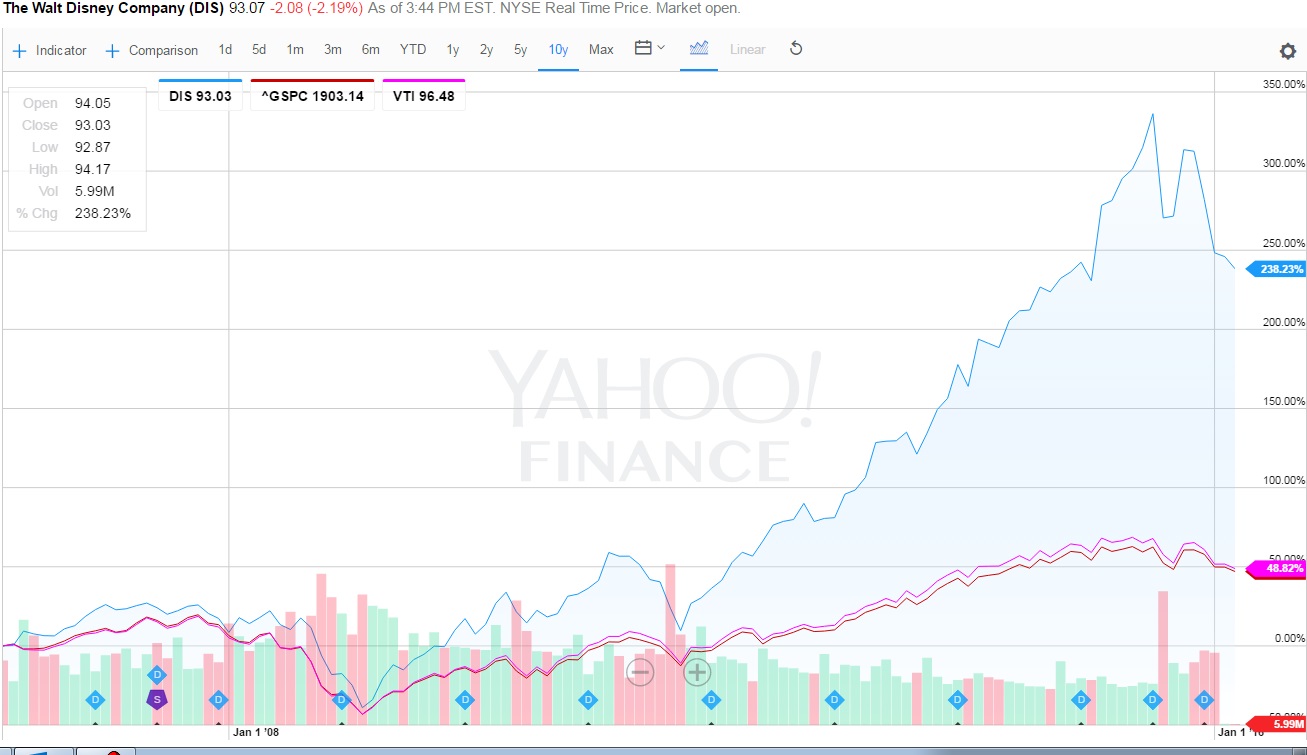

How’s Disney fair against the S&P 500 and VTI?

What’s in the work for Disney?

2016 Walt Disney Studios Movie Lineup

January 29 – The Finest Hours

March 4 – Zootopia

April 15 – The Jungle Book

May 6 – Captain America: Civil War

May 27 – Alice Through the Looking Glass

June 17 – Finding Dory – a sequel to Finding Nemo. I love this movie.

July 1 – The BFG

August 12 – Pete’s Dragon

November 4 – Doctor Strange

November 23 – Moana

December 16 – Rogue One: A Star Wars Story

Fall 2019 – The Queen of Katwe

TBD 2019 – The Light Between Oceans

Potential Stock split?

The last time DIS split was when the stock was in the $100s. I don’t know what DIS will decide, but if they do 2:1 the stocks price will make it look attractive to new buyers again. It probably will not do anything for me short-term, but long term it will be great.

Disney Earning?

With the success of the new Star War movie, and record breaking in ticket sales. Whether, Disney will meet analysts expectations or not, I’m sure the earning will be good. Regardless, how’s the stocks will be doing. One thing for sure is DIS theme parks did well through out the deepest of the recession.

Conclusion:

- Diversify income streams

- Impressive dividend growth

- Ability to sustain during the recession

- New theme park in the line up in China

- New Movies in the line up

DIS is a buy in my book.

Full disclosure: I’m long DIS.

Hey Vivianne,

Nice pick. DIS is a hell of a quality stock. Personally, I’m not a fan of the low yield, but as you said the growth prospects are worth it. Definitely curious to see what they report for earnings, as I’m certain everyone else is. Keep at it!

DB

DB,

Thanks so much! Always appreciate the support and enthusiasm.

I’m also curious about their earning. Aapl and Disney seems to give very low guidance, so that they can always beat. However, with the strengthening of the dollars, it would definitely hit the profit. Not to mention investors would sell at any sight of a deep sell off. However, I’d just take this opportunity to buy.

Thanks again for visiting and commenting.

Ciao Vivienne,

I own a “little” bit of Disney, mostly for growth potential and diversification purposes, I missed my chance to increase the position at the beginning of January., but let’s say that I had other more interesting stocks to buy then… Still a good company and I also hope to see that dividend rise quickly in the coming years…. 🙂

Great buy! DIS is a diversified entertainment giant. I think purchasing Star Wars alone was a huge boost to the future cash flows of the company. The one interesting thing is what’s going on with ESPN. I love sports, so I always get a kick when I read about some of the struggles that are happening at the network. DIS is the kind of company that will find new ways to generate new streams of cash flow for investors. A great low yield, high growth rate stock. Great buy and addition to your portfolio!

Bert

DIS crushing earning today despite the unreasonable market sell off. Looking to see if dis will increase its dividend again this year!