Has everyone portfolio fully recovered yet? What a wild crazy few months seeing the S&P with 10% correction. Anyhow, Most of the everyone’s portfolio should be recovering, some of you who has taken advantage of the sell off might even seeing the bigger jump. My account went back to the $200K level, there is nothing to brag, as it has been more difficult to buy since the stock has recovered.

But I manage to find a few stocks that are majorly undervalued, and I consider them as deals right now WMT and KMI. I’ve recently added another 10 shares of KMI, this will add $20.4 to my yearly dividend or at the yield of 7.48% on $27x.xx investment. BAC is half of my portfolio and paying around 1% in dividend, to offset that, I have AT&T, KMI, and a few REITs on my portfolio to increase the overall yields.

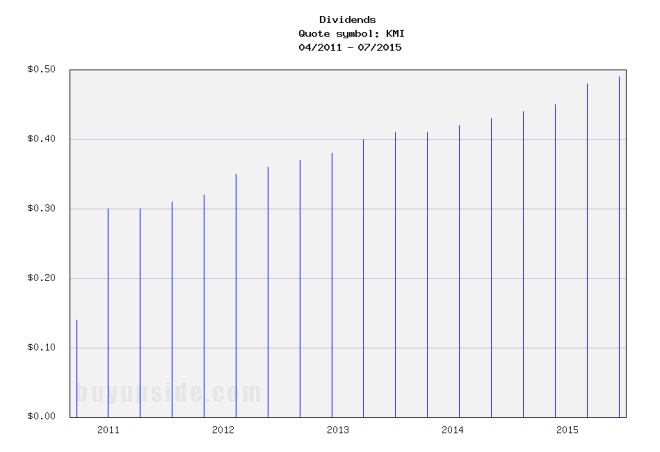

Kinder Morgan, Inc. (NYSE: KMI) is one of the largest energy infrastructure firms in North America. It consists of six lines of business that operate 84,000 miles natural gas pipelines, 165 terminals and other product pipelines throughout Canada and the United States. In 2011, KMI separated from its parents company – Kinder Morgan Energy Partners, Kinder Morgan Management and El Paso Pipeline Partners. Kinder Morgan became one of the largest firms specializing in midstream energy. The company is one of the first to start taking advantage of master limited partnerships (MLPs) and their tax-free status. Since 2011, Kinder Morgan has consistently paid dividends and steadily increased them every year.

Kinder Morgan, Inc. (NYSE: KMI) is one of the largest energy infrastructure firms in North America. It consists of six lines of business that operate 84,000 miles natural gas pipelines, 165 terminals and other product pipelines throughout Canada and the United States. In 2011, KMI separated from its parents company – Kinder Morgan Energy Partners, Kinder Morgan Management and El Paso Pipeline Partners. Kinder Morgan became one of the largest firms specializing in midstream energy. The company is one of the first to start taking advantage of master limited partnerships (MLPs) and their tax-free status. Since 2011, Kinder Morgan has consistently paid dividends and steadily increased them every year.

What is KMI dividend policy?

KMI is structured as MLP. Think of it as a REIT of energy sector. It must pay over 90% of their earnings to remain exempt from paying federal income taxes, resulting in a high overall payout ratio. The payout ratio ranged from 162% in 2011 on a prorated basis to 253% in 2017, indicating Kinder Morgan paid more than it earned. However, depreciation is one of the largest noncash expenses on the income statement, resulting in sufficient cash from operations to cover cash dividends.

Kinder Morgan typically pays declared dividends to common shareholders on or about the 16th day of each February, May, August and November. I have a small February payout, so adding more KMI should booster my cash flow.

What’s KMI dividend yield?

The dividend yield constantly changes as a result of market price fluctuations and occasional changes in dividend policy. From 2011 to 2018, the company’s low and high stock prices were $23.81 and $44.34, respectively. As the company’s dividend increased over the years, its dividend yield fluctuated from 2.63% in April 2017 to 7.48% October 2018. This increase in the dividend yield was primarily attributable to an over 33% decline in equity price from the stock’s high in April 2018 as a result of worries over the long-term impact of decreases in oil and natural gas prices. From 2011 to 2018, the dividend yield was about 4% on average.

- In 2011, the company declared and paid dividends that ranged from $1.20 per share in 2011 on a prorated basis to $1.80 to September 2018.

- The dividend per share grew by approximately 10.6% from 2011 to 2018.

- Kinder Morgan expects to pay a $2 dividend per share for the fiscal year of 2018, which is a 15% increase compared to the 2017 dividends per share.

- KMI vs Peers – Kinder Morgan’s dividend yield of 6.3% is much higher than the industry’s average of 3.13%. *Note: Peers have lower payout ratios compared to Kinder Morgan.

image credit: https://g.foolcdn.com/editorial/images/178825/kmi-dividend_large.png

Is KMI dividend safe?

- Kinder Morgan’s dividend growth is likely to continue being driven by increasing demand for energy infrastructure in North America.

- As the need for transportation and storage of natural gas, crude oil and refined products increases in the U.S. and Canada, the company’s cash flows are likely to grow.

- Also, contributions from Kinder Morgan’s expansion projects across business units are poised to grow, helping with dividend increases.

Kinder Morgan’s cash flow from operations has grown substantially from 2011 to 2017, with an average annual growth rate of about 24%. - As of September 2018, the trailing 12-month operating cash flows of $4.8 billion was enough to cover $4 billion of dividend payments in the trailing 12 months and resulted in a dividend coverage ratio of 121%. However, because the company spent $5 billion to $6 billion on asset acquisition in 2017-2015, Kinder Morgan relied heavily on borrowing cash from its existing credit facilities to cover the cash deficit.

- As the company’s capital expansion peak in 2017-2015 subsides, Kinder Morgan should be able to rely less on borrowing to finance its dividend commitments.

One of the greatest threats to the company’s dividend policy is prolonged price decline for oil and natural gas, which seems likely for the foreseeable future. Kinder Morgan’s budgeted oil price to sustain its dividend per share of $2 is $70 per barrel and its natural gas price is $3.8 per one million British Thermal Units (MMBTu). If the oil and natural gas prices remain below these values, there is a danger of a dividend cut or a complete suspension of dividend payments until energy prices stabilize. Also, Kinder Morgan routinely hedges its exposure to energy price fluctuations, which may mitigate the negative effect of low energy prices. Kinder Morgan disclosed that it expects $8 billion of earnings before depreciation and amortization, which should sustain its current level of dividend payments for 2018.

What are the expectations?

- KMI organically grows by borrowing to buy more assets pose threat to Kinder Morgan’s dividend policy.

- Yet, as these new assets are put to use and the energy prices stabilize after the demand and supply imbalance is corrected, the company’s sheer size and reach across the North American continent and cash flow potential should generate sufficient funds to cover dividends.

- Also, as demand for energy infrastructure wanes, Kinder Morgan will have to slow down its dividend policy increases and transition to a mature growth eventually.

- Potential interest rate increases in the U.S. in 2018-2016 may pose additional danger to Kinder Morgan’s growth story, as the company becomes much more expansive to fund existing and new investment projects with debt.

What are the main takeaways?

- The fact that management maintains such a positive outlook about the dividend speaks to the strength of its underlying business.

- Demand for energy infrastructure is still sound in the U.S., and Kinder Morgan’s cash flow covers its dividend and then some.

- For income investors, Kinder Morgan may still be an attractive option.

- 2.1 Buying Rating

Image credit: Yahoo finance

What do you think? Are you going to wait until interest rate actually increase to add more energy? Or waiting until Iranian Oil come to the market to see if the Oil Market stabilize first?

Nice purchase, Vivianne. KMI may have lowered the forward div growth from 10% to a range of 6-10%, but with a starting yield of 6.5-7%, thats still pretty amazing growth. The only concern is to see how they will keep those earnings growing and how their cash/investments are deployed, but they have time on their hands to figure it out and I have full confidence in management to do the right thing.

cheers

R2R

Thank you for stopping by and commenting.

My guess is if the demand for oil and gas remain low, most of these high yielders like BP, NOV, KMI, and small utilities will either merge or break up, like the smooth move was doing, and effectively cutting dividend without using forbidden word. 🙂

Solid buy Vivianne. We plan to add more KMI stocks in the future as well. Solid company with great dividend growth.

It’s off about 40% from the year high, the stock couldn’t seem to find the bottom, but No one knows where is the bottom, average down is a the best way at this point. Every 10 shares, I earn $20, as long as I don’t sell, keep using the dividend to buy more shares, I hope the snowballing effect will outpace the falling of stockprice. 🙂

Nice buy Vivianne. KMI is a great stock and at its current stock price it is a great buy.

Nice add with KMI. It’s probably one of the blue-est blip chip pipeline MLP that’s out there. Seems like a newly popular name among the DGI bloggers as I have seen quite a few other bloggers buying into this name.