“Be fearful when others are greedy, be greedy when others are fearful” per Mr Buffett. Yes, the market can go all the way down to 15,000 or even 8,000 but do we know for sure? Nope, so I’ll stick the the plan and blue chips.

But first, I’ll like to see what other bloggers are saying about the market down turn

Jason, at dividend mantra “Time In The Market Trumps Timing The Market For The Long-Term Investor”

Financial samurai, “Stock Market Meltdown Implications For Everyone”

Retireby40 “Are You Prepared For The Next Stock Market Crash??

thinksaveretire, As the stock market slides, remember long haul victory

Tawcan ” Breathe, relax, world is not ending”

Learn from history:

A weekly drop of more than 5 percent has only happened 28 other times since 1980. And here is the numbers:

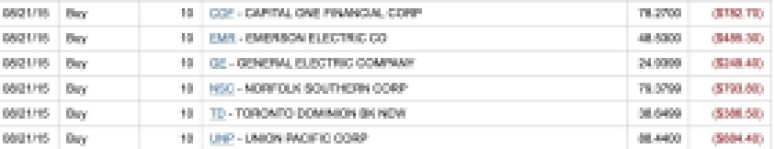

Here comes the buys

With the 8-10% in discount when I picked up these stock, I get more bang for my bucks.

I bought 10 shares of COF in Jan, and the stock went all the way up, I regretted didn’t buy more, so now it’s pulled back not because the companies is broken, just the broken market.

10 shares of GE, GE was going all the way up to $28 because the companies is selling it’s financial units, the CEO has promised to return capital to shareholders with stock buy back and dividend. So why not at $24?

10 shares of NSC, and UNP again, they are making money, just lower revenues and broken market, so buy, baby buy? 🙂

10 shares of EMR, I like manufacture, I haven’t had any in my portfolio, correction is the time to add to my portfolio.

10 shares of TD, yes, I’m determine to amp up my Canadian bank mini ETFs,so I’m doing just that.

what will be next on Monday, potentially “black Monday”? I still have money to deploy, so I’ll ramp up the buys. The first half of the year, I’ve been buying dividend growth stock 2-4%, the second half of the year! I’ve been buying stocks with 4-10% yield. This should boost my over the quarter dividend growth.

I’m on the look out for metal and oil companies. However, they haven’t seem to find the bottom yet as they are depending on the world demand and Chinese consumption and production, not to mention the over production as the result of black gold rush.

Leave a Reply